8 frequently asked questions about a quick loan app.

Not too long ago, getting a loan was considered quite complex. One had to fill long and arduous forms and provide a never-ending list of documents to successfully complete the loan application. Even after the application was submitted, it could take days or weeks for the loan to be approved.

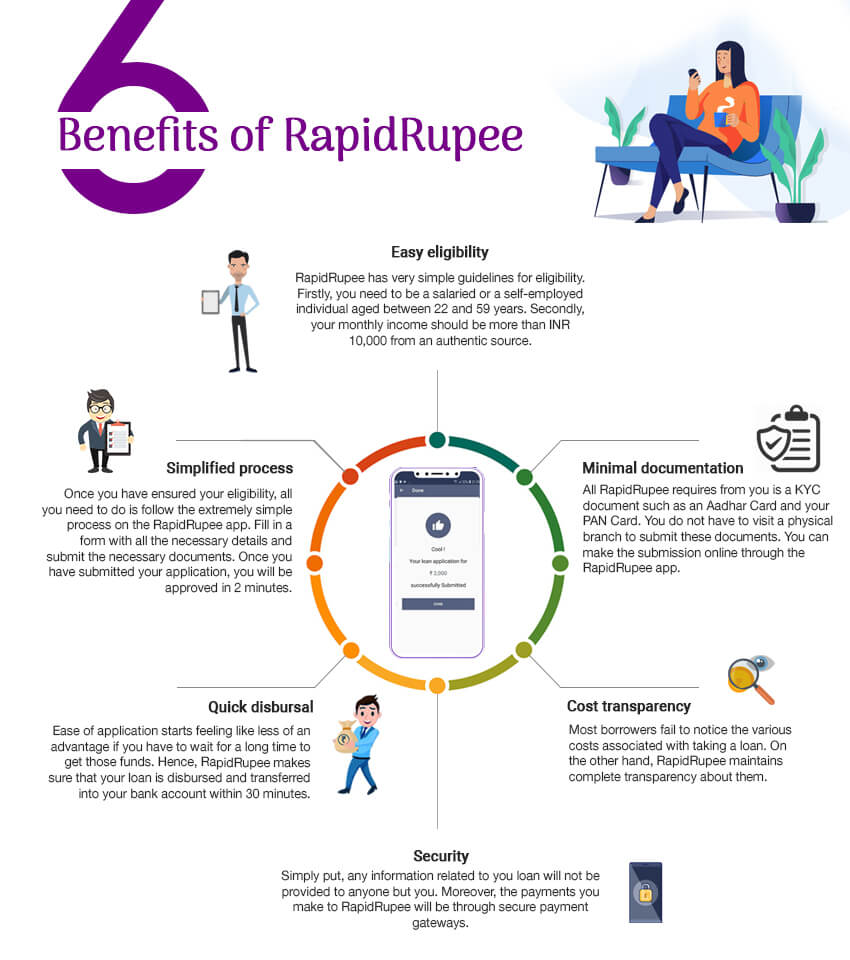

Snap to the present day, where RapidRupee can help you get your hands on quick cash in as little as 30 minutes! The process too is quite simple; some would say it is akin to ordering food online. Just get onto the app, tap in a few details, upload a couple of your documents, take a selfie, and your application is complete – you should get your sanction in no time.

However, since RapidRupee and others like us are relatively new to the market and most have never used a quick loan app, there are bound to be some doubts, questions and queries that could cloud the mind of potential borrowers. Well, worry not, we’ve gone ahead and answered 8 of the most frequently asked questions about a quick loan app. Hopefully, it should alleviate any doubts in your mind and help you use a quick loan app with confidence.

1. What is a quick loan app?

Let’s begin with the basics. This is the first question that pop-ups amongst those who are not acquainted with a quick loan app in India. These apps provide personal finance solutions, generally small loans starting from Rs. 1,000. The upper limit differs from one lender to the next; at RapidRupee we provide loans as high as Rs. 20,000. Also, since these apps offer smaller finance solutions, their tenures are also generally shorter than that of a traditional personal loan. Lastly, from the term ‘quick loan app’, it becomes obvious that such finance solutions deliver extremely quick turnaround times. To sum-up, a quick loan app in India is one that usually provides small, short-term finance solutions in a quick manner!

2. Who can take a quick loan?

Generally speaking, anyone with a smartphone can use a quick loan app in India. However, different apps will have different eligibility criteria by which they select borrowers. If you do not satisfy these criteria, your application could be rejected. Usually, these criteria include minimum age & income requirements. For example, we require borrowers to be between the age of 22 and 59. Also, we require that borrowers have a minimum income of Rs. 10,000. Other lenders require much higher monthly income amounts and also require a credit score. However, we want to make it easier for you to get the loan you need and that’s why we skip credit scores and set the bar as low as possible as far as minimum income is concerned.

3. What are the documents required for a quick loan app?

Every quick loan app in India will require certain documents to provide you a loan. At RapidRupee, our main goal is to make things easier for you. That’s why our loans are made available to you with just 2 documents – your Aadhaar Card and your PAN Card. Scan and upload these documents and you’re good to go! What about a photograph you ask? Well, just click a selfie and that’s about it!

4. Is it safe to use a quick loan app?

Many people assume that the internet is an unsafe place. However, this is far from the truth. You can transact with complete security as long as you deal with trustworthy entities. So when it comes to a quick loan online, all you have to do is find a safe lenders and everything will be alright. You can read the reviews on the Play Store, check the number of downloads and go through ratings of the app. At RapidRupee, we ensure the safety of your transaction by using a secure HTTPS connection & 128-bit SSL encryption.

5. How do you apply for such a loan?

As mentioned early, getting a loan is considered an extremely tumultuous task. However, the best quick loan app will make things super-smooth. For example, with RapidRupee, you can apply for a loan in just 3 steps. Once you’ve downloaded the app, just fill in the required details, upload your documents and take a selfie! After these 3 simple steps, your loan will be approved almost instantly and you should get transfers directly to your bank account.

6. Where can I find a quick loan app?

That’s easy! If you’ve stumbled upon this blog, then finding RapidRupee is easy, just click on this link and you will redirected to the Play Store from where you can easily download our app. However, if you want to find more options, just head on to your web browser and make a search for ‘quick loan app India’. You should find numerous alternatives to choose from.

7. What can I use a quick loan app for?

This is probably one of the best part of a quick loan app in India – you can use the amount for any purpose you deem fit. Regardless if it’s your child’s school fees payment, automobile repair costs, a home renovation that’s been on your mind, etc. You can even use it to cover your travel plans, a dinner date or even for your grocery bills. How you use the loan is completely up to you!

8. How long are the repayment tenures?

Again, since loan amounts are generally on the lower side, you do not need too much time to repay the loan. But we understand that juggling EMI payments with numerous other expenses can be difficult, which is why we provide you your tenures up to 12 month to repay your loan. This ensures smaller EMIs, helping you cake walk through the repayment of your quick loan.

We hope these answers have furthered your understanding of quick loan apps in India. If you have any further doubts, you can check out our entire list of FAQs or get in contact with us. But remember; never apply for a loan without being completely sure of what you are getting into.