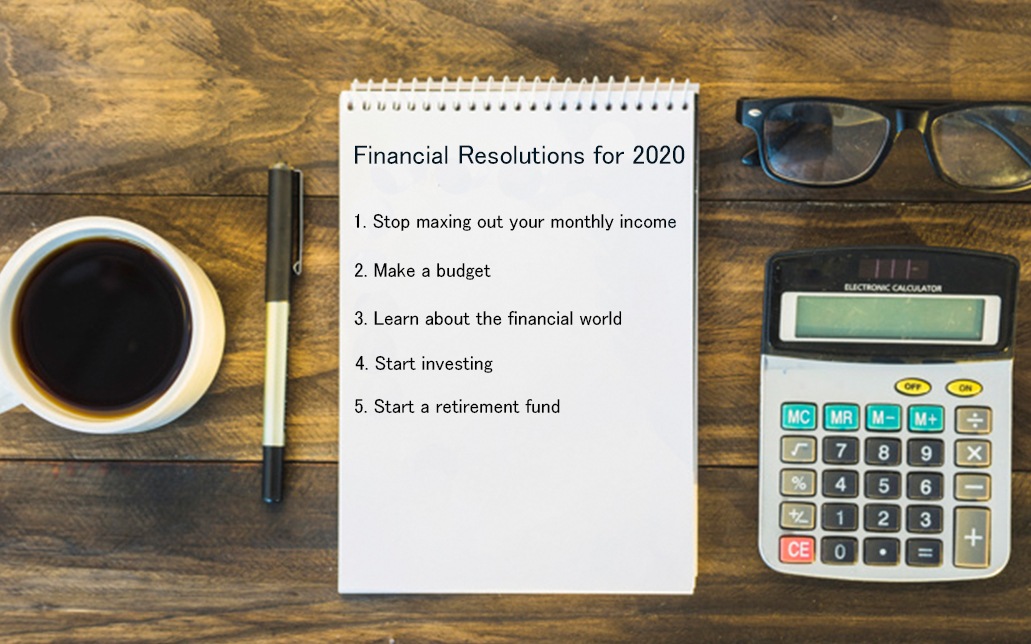

5 financial resolutions for the New Year

Resolutions are something we decide on in order to bring improvement in our lives. There is no better time than the start of a new year to bring about order and organization in our habits to successfully accomplish the resolutions that we make.

For those looking to improve their finances in the coming year, we can help by providing some tips that if followed religiously, could bring about a significant rise in their account balance.

Here are the 5 financial resolutions one should include in their planner so as to see growth in their bank balance:

Stop maxing out your monthly income

This is the first step you take towards thinking about the future. This mindset is very common among people who have just started earning, as they look to swipe out their entire income before their next paycheck arrives.

This is usually the case when the person doesn’t have as many responsibilities, and thus does not see the need to save any funds. However, this attitude would affect their future, as the importance of savings cannot be stressed enough upon.

Make a budget

Once you decide on saving and not living from paycheck to paycheck, start making a budget to follow so that you can keep a track of your expenses and know where to save.

Once you have prepared a budget, you get a better judgement of the areas you can save a little extra. Proper management of your finances is crucial for sticking to your budget, and even improve them.

Learn about the financial world

It is very important to have knowledge about the various policies of the financial institutions, so that you can put your money in the right place where you will get a good return on investment.

Make an effort to study about these quick loans online from your family as they are experienced in these cases. You can find a lot of information online or even by reading financial books, which will help you immensely.

Start investing

Investing your money is very important. A lot of people do not follow practice investing their money, as they feel that the market as of today is not faring well. However, one should understand that investing your money is the only way for it to grow.

Sure, you cannot be expected to invest in something you do not entirely understand. In order to do this, make an effort in understanding the working of the stock market and all its risks and benefits. Once you understand the system, you will be confident of investing in shares that you can make a profit of.

Start a retirement fund

When you make a budget, keep in mind that at least 10% of your income should be your savings. Also, another way to save up more is to collect all the change and keep adding them to your account. Spend only in whole amounts and the rest of the change collected goes towards the savings.

This doesn’t seem like much, but you’d be surprised at the amount that gets collected by the end of the year. A retirement fund is a very important saving that you would be thanking yourself for in the future.

We understand that resolutions can be hard and financial resolutions, even more so! Therefore, if the going get hard, you can turn to us to help you instead of breaking your promises to yourself. Hope this has been helpful, may the New Year bring you good luck and prosperity.